How Much is One Pip in Forex

In the world of Forex trading, understanding the concept of a “pip” is fundamental for successful trading and effective risk management. This article provides an in-depth perspective on what pips are, their significance in currency valuation, and practical examples of how to calculate their monetary value in various scenarios.

Understanding the Concept of a Pip in Forex Trading

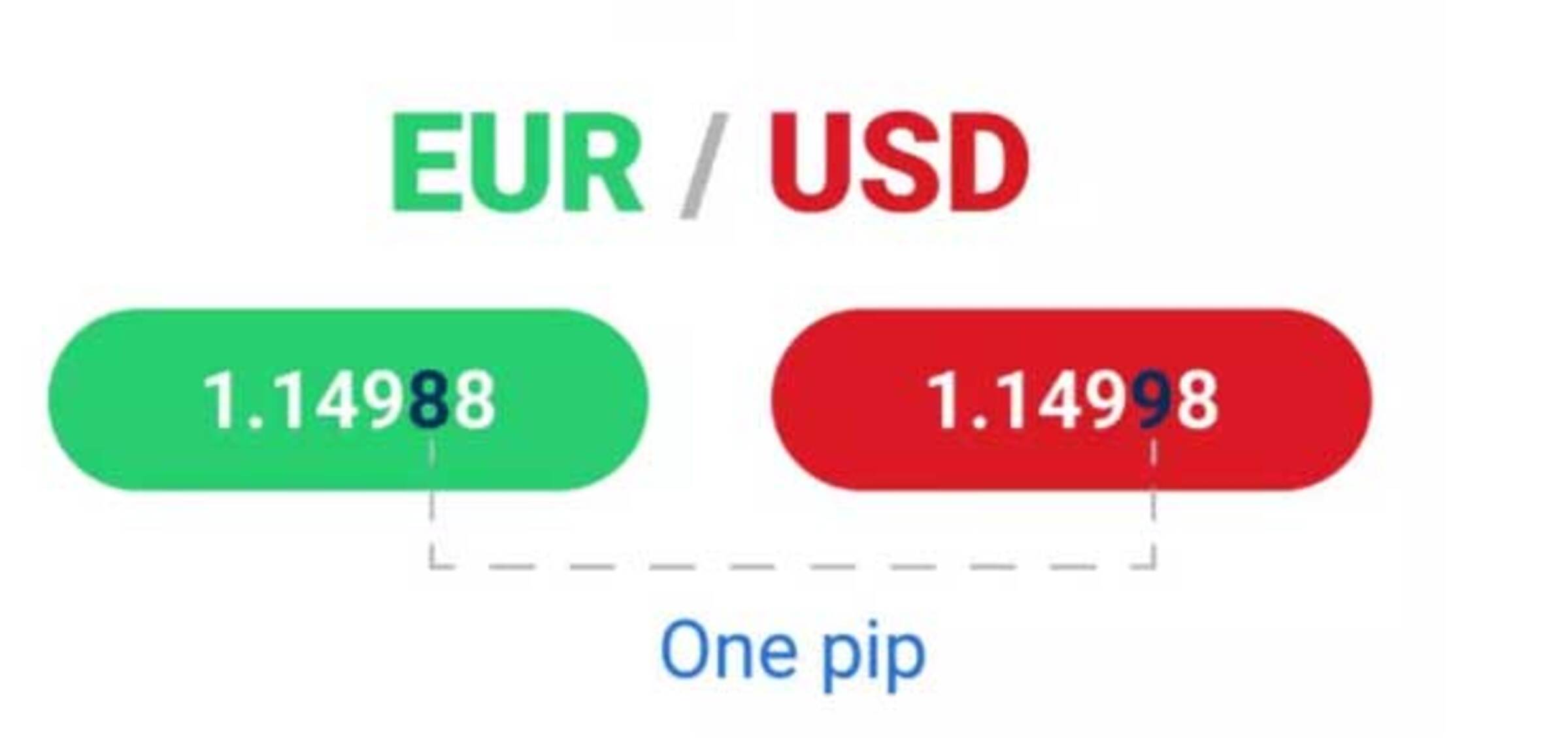

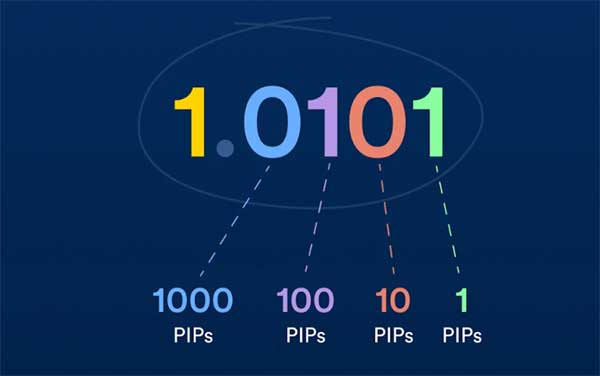

A pip, short for “percentage in point,” is the smallest price movement that a given exchange rate can make based on market convention. Typically, in most currency pairs, a pip is equal to 0.0001. For example, if the EUR/USD moves from 1.1050 to 1.1051, that is a movement of one pip.

Key Points:

- The standard pip value is 0.0001.

- It is essential for measuring price changes in currency pairs.

- Pip values can differ depending on the currency pair and the size of the trade.

The Importance of Pips in Currency Pair Valuation

Pips play a vital role in Forex trading as they are the primary unit of measurement for price movements in currency exchange rates. Understanding how to read and interpret pips can significantly influence trading strategies and risk management practices.

Why Pips Matter:

- Risk Assessment: Knowing the pip value helps traders assess potential risk and reward in their trades.

- Performance Measurement: Traders use pips to evaluate the performance of their trades over time.

- Market Analysis: Pips provide insight into market volatility and price fluctuations.

Calculating the Monetary Value of One Pip

The monetary value of one pip depends on several factors, most notably the size of the trade (also known as the lot size) and the specific currency pair being traded. The formula for calculating the pip value is:

Pip Value Formula:

[ text{Pip Value} = left( frac{text{One Pip}}{text{Exchange Rate}} right) times text{Lot Size} ]

Example Calculation

For instance, if you are trading a standard lot of 100,000 units of EUR/USD, with an exchange rate of 1.1050, the pip value can be calculated as follows:

- Identify One Pip: 0.0001

- Determine Lot Size: 100,000 units

- Apply the Formula:

[

text{Pip Value} = left( frac{0.0001}{1.1050} right) times 100,000 approx 9.05 text{ USD}

]

This means that for a one-pip movement in the EUR/USD pair, your profit or loss would be approximately $9.05 per standard lot.

Factors Influencing Pip Value in Different Forex Markets

Several factors can influence the pip value, including:

- Currency Pair: Different currency pairs may have varying pip values due to exchange rates.

- Lot Size: Standard (100,000 units), mini (10,000 units), and micro (1,000 units) lots will affect the monetary value of a pip.

- Market Conditions: Fluctuations in market volatility can impact the real-time value of pips.

- Base Currency: The currency you are trading can also affect how much a pip is worth in your account currency.

Comparative Table: Pip Values in Different Lot Sizes

| Lot Size | Units | USD Value of 1 Pip (e.g., EUR/USD at 1.1050) |

|---|---|---|

| Standard | 100,000 | $9.05 |

| Mini | 10,000 | $0.905 |

| Micro | 1,000 | $0.0905 |

Practical Examples: Pip Value in Real Trading Scenarios

Understanding pip values is crucial for making informed trading decisions. Here are a few scenarios showing how pip calculations can influence trading outcomes:

- Scenario 1: Trading a Standard Lot

- Pair: GBP/USD

- Exchange Rate: 1.3000

- Lot Size: 100,000

- Pip Value Calculation:

[

text{Pip Value} = left( frac{0.0001}{1.3000} right) times 100,000 approx 7.69 text{ USD}

]

- Scenario 2: Trading a Mini Lot

- Pair: USD/JPY

- Exchange Rate: 110.00

- Lot Size: 10,000

- Pip Value Calculation:

[

text{Pip Value} = left( frac{0.01}{110.00} right) times 10,000 approx 0.909 text{ USD}

]

- Scenario 3: Trading a Micro Lot

- Pair: EUR/GBP

- Exchange Rate: 0.8600

- Lot Size: 1,000

- Pip Value Calculation:

[

text{Pip Value} = left( frac{0.0001}{0.8600} right) times 1,000 approx 0.116 text{ GBP}

]

Conclusion: Mastering Pips for Forex Trading Success

Understanding the concept of a pip and how to calculate its value is essential for any Forex trader. By mastering this knowledge, traders can better assess risks, manage their trades, and ultimately enhance their trading performance. With this foundational understanding, you are now equipped to navigate the Forex market with greater confidence and strategy. Whether you are a novice or an experienced trader, the ability to accurately calculate pip values will serve you well on your trading journey.

I learned that a pip is very small but important in Forex trading.

‘Lot size’ and ‘pip value’ are new terms for me. This is very helpful!

Understanding pips can change how you trade. Good information here!

Calculating pip values seems complicated, but the examples help a lot.

‘Pip value formula’ looks tricky, but the article breaks it down nicely.

‘Risk assessment’ sounds important, and I see why pips matter now.

‘Market volatility’ affects pips too? That’s good to know for trading.

This article explains pips really well. I didn’t understand before!

‘Percentage in point’ makes sense now. Thanks for clarifying this!

‘Practical examples’ make it easy to understand how to trade effectively.