What is Non Farm Payroll in Forex

Non-Farm Payroll (NFP) is one of the most significant economic indicators in the United States and has far-reaching implications for the global financial markets, particularly in the Forex (foreign exchange) arena. This article delves into the NFP, its impact on currency trading, and provides insights into effective trading strategies surrounding its release.

Understanding Non-Farm Payroll: A Key Economic Indicator

NFP refers to the total number of paid workers in the U.S. excluding farm workers, private household employees, government employees, and a few other categories. Released monthly by the Bureau of Labor Statistics, the NFP report provides a snapshot of the U.S. economy’s health, showcasing job creation trends and employment rates.

Key Components of the NFP Report:

- Total Non-Farm Payroll Employment: This figure represents the total number of jobs added or lost during the previous month.

- Unemployment Rate: A percentage indicating the portion of the labor force that is unemployed and actively seeking employment.

- Average Hourly Earnings: Reflects wage growth, which can signal inflationary pressures.

- Revisions: Adjustments made to previous months’ employment figures, which can influence market sentiments.

How NFP Affects Forex Markets and Currency Trading

The NFP report significantly impacts the Forex markets because it provides insights into economic health and influences monetary policy decisions by the Federal Reserve. A strong NFP report typically indicates a growing economy, often leading to a strengthening of the U.S. dollar (USD), while a weak report can trigger concerns about economic slowdown, leading to a depreciation of the USD.

Impact on Currency Pairs:

- USD/EUR: A positive NFP report tends to strengthen the USD against the euro, as investors expect interest rate hikes.

- USD/JPY: Similar to the EUR, a robust NFP can see the dollar appreciating against the yen.

- AUD/USD: The Australian dollar often reacts inversely to the NFP, given its correlation with commodity prices and global risk sentiment.

| Currency Pair | NFP Strong | NFP Weak |

|---|---|---|

| USD/EUR | USD strengthens | USD weakens |

| USD/JPY | USD strengthens | USD weakens |

| AUD/USD | AUD weakens | AUD strengthens |

The Role of NFP Reports in Economic Forecasting

Investors and traders analyze NFP data to gauge economic conditions and make predictions about future trends. For instance, consistent job growth can signal consumer spending strength, while declining employment can indicate economic contraction.

Importance for Central Banks:

Central banks, particularly the Federal Reserve, closely monitor NFP data as it influences interest rate decisions. A strong labor market often prompts the Fed to consider tightening monetary policy to combat inflation, while weak employment figures may lead to lower interest rates to stimulate economic growth.

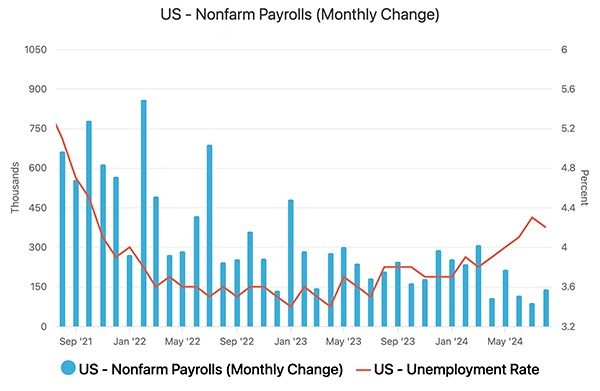

Analyzing Historical NFP Data: Trends and Patterns

Studying historical NFP data helps traders identify trends and make informed trading decisions.

Key Historical Trends to Note:

- Seasonal Patterns: Employment numbers can fluctuate due to seasonal hiring, particularly in retail and agriculture.

- Revisions: Previous NFP data are often revised, which can cause the market to react differently than initial reports suggested.

- Market Reactions: Analyzing how the markets reacted in the past to various NFP reports can provide insights into potential future reactions.

Practical Example:

In May 2021, the NFP report showed a significant miss, with only 266,000 jobs added against expectations of 1 million. This led to a rapid decline in the USD as traders recalibrated their expectations regarding the Federal Reserve’s monetary policy.

Strategies for Trading Forex Around NFP Releases

Trading the Forex markets around NFP releases requires a well-thought-out strategy. Here are some effective approaches:

1. Pre-NFP Positioning:

- Analyze the consensus forecast and position accordingly before the report is released.

- Use limit orders to enter trades at key support and resistance levels.

2. Volatility Trading:

- NFP releases typically create increased volatility. Traders can capitalize on sharp price movements by employing a breakout strategy.

- Utilize stop-loss orders to manage risk effectively.

3. Post-NFP Analysis:

- After the release, analyze the market reaction before entering trades. Sometimes, markets may overreact, creating opportunities for reversal trades.

Common Misconceptions About Non-Farm Payroll Explained

- NFP is the Only Indicator to Watch: While NFP is crucial, it should be interpreted alongside other economic indicators like GDP growth, consumer spending, and inflation rates.

- A Strong NFP Always Equals a Strong USD: Market reactions can be unpredictable. Sometimes, even a strong NFP can lead to a weaker USD due to other underlying factors.

- NFP Only Affects the U.S. Markets: The global interconnectedness of financial markets means that NFP results can influence currencies worldwide, affecting forex liquidity and trading strategies globally.

Conclusion

Non-Farm Payroll is a pivotal economic indicator that not only reflects the state of the U.S. labor market but also provides critical insights for currency traders in the Forex market. Understanding its implications and effectively strategizing around NFP releases can enhance trading success and decision-making. Traders must remain vigilant about market reactions, historical trends, and the broader economic context to navigate the complexities of currency trading successfully.

‘Seasonal patterns’ in employment numbers is something I never considered before this article.

‘Common misconceptions’ section is eye-opening. I always thought strong NFP equals strong USD.

The connection between NFP and interest rates is really informative. Great read!

‘Post-NFP analysis’ is a great tip! I’ll use that in my trading strategy going forward.

‘Volatility trading’ sounds like a smart strategy around NFP releases. Thanks for sharing!

Good to know how strong NFP can strengthen the USD against other currencies.

I didn’t know NFP is so important for traders. Thanks for breaking it down!

‘Historical trends’ are useful to understand future market movements. Very helpful article!

This article explains Non-Farm Payroll very well. I learned that it affects the Forex market a lot.

Interesting to see how job reports influence the economy and currency values.