What Time is London Session Forex EST

The foreign exchange (Forex) market operates 24 hours a day, allowing traders worldwide to participate at their convenience. Among the various trading sessions, the London Forex session is highly regarded for its liquidity and volatility. Understanding the timing of this session in relation to Eastern Standard Time (EST) is crucial for traders looking to optimize their strategies.

In this article, we will explore the key features of the London Forex trading session, its significance for traders, and practical tips for maximizing profits during these hours.

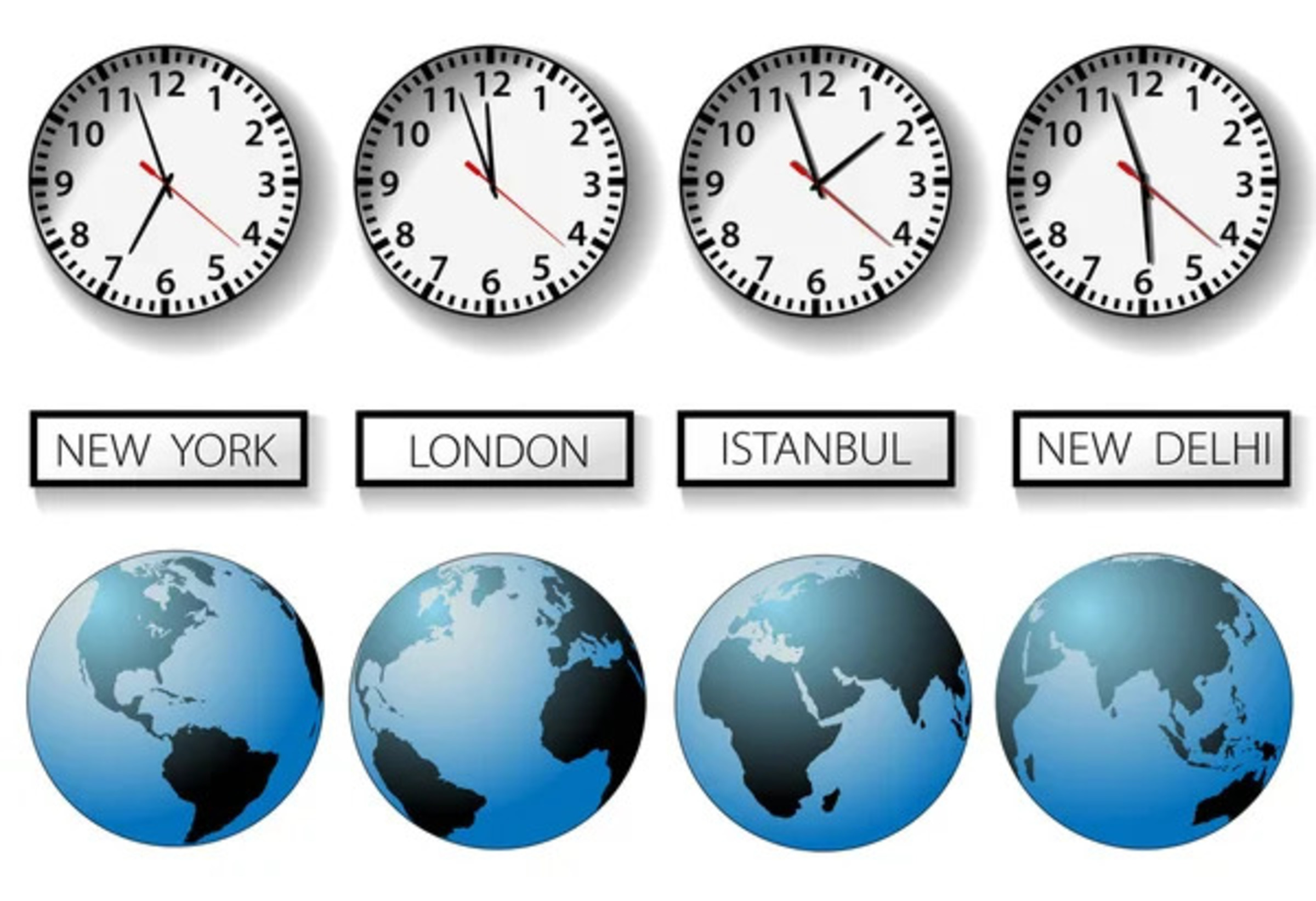

Understanding the London Forex Session Timing in EST

The London Forex session is one of the most important trading periods in the Forex market. It operates from 3:00 AM to 12:00 PM EST. During this time, the market witnesses increased trading activity due to the overlap with other major sessions, particularly the Asian and New York sessions.

London Session Hours in EST:

| Session | UTC Time | EST Time |

|---|---|---|

| London Session | 8:00 AM – 5:00 PM | 3:00 AM – 12:00 PM |

This overlap provides traders with unique opportunities to capitalize on market movements and increases the potential for significant price action.

Key Features of the London Forex Trading Session

The London session is characterized by several key features:

- High Liquidity: The London session sees the highest trading volume, resulting in better liquidity for traders. This is crucial as it allows for tighter spreads and less slippage.

- Major Currency Pairs: The most traded currency pairs, including EUR/USD, GBP/USD, and USD/JPY, see a significant amount of trading activity during this period.

- Market Influences: Economic data releases and geopolitical events often occur during this session, impacting currency prices and creating volatility.

- Overlap with Other Sessions: The London session overlaps with the New York session, which further boosts trading activity and opportunities.

Importance of the London Session for Forex Traders

The London Forex session is essential for traders for several reasons:

- Opportunity for Profit: With increased volatility and liquidity, traders can find favorable conditions for both short-term and long-term trades. Price movements are often more pronounced during this session.

- Economic Data Releases: Many significant economic reports, such as GDP, employment figures, and central bank announcements, are released during this time. Traders who are aware of these events can position themselves advantageously.

- Market Sentiment: The London session helps to set the tone for the rest of the trading day. Understanding market sentiment during this period can provide insights into potential price movements later on.

Converting London Session Hours to Eastern Standard Time

As mentioned earlier, understanding the conversion of London session hours to EST is vital for accurate trading execution. Here’s a breakdown of key time conversions:

- London Open: 8:00 AM GMT / 3:00 AM EST

- London Close: 5:00 PM GMT / 12:00 PM EST

Time Zone Considerations:

- Daylight Saving Time: Be aware of Daylight Saving Time (DST) changes, as they can affect session timings. During DST, London adjusts to GMT+1, and EST becomes EDT (GMT-4), shifting the session timings accordingly.

Tips for Trading During the London Forex Session

To effectively navigate the London trading session, consider the following tips:

- Prepare for Volatility: Be ready for potential spikes in volatility, especially during major economic announcements. Use stop-loss orders to manage risks.

- Focus on Major Currency Pairs: Concentrate on the most actively traded pairs to benefit from higher liquidity. Pairs like EUR/USD and GBP/USD typically offer better trading conditions.

- Stay Updated on News Releases: Keep track of economic calendars, and be informed about upcoming news releases that could impact your trades.

- Establish a Trading Plan: Develop a clear trading strategy with defined entry and exit points. Stick to your plan to avoid emotional trading during volatile periods.

- Practice Risk Management: Effective risk management techniques, such as position sizing and diversification, are crucial for long-term success.

Maximizing Profits in the London Trading Hours

To maximize profits during the London session, traders can implement advanced strategies:

- Scalping: This short-term trading strategy takes advantage of small price movements. High liquidity during the London session facilitates successful scalping.

- Breakout Trading: Watch for price breakouts at key levels of support and resistance, especially during the news announcements. This approach can lead to substantial gains.

- Technical Analysis: Use technical indicators to identify trends and potential reversal points. Tools like moving averages and RSI can be particularly useful.

- Continuous Learning: Stay educated on Forex trading strategies and market dynamics. Regularly review your trades to understand what works and what doesn’t.

In conclusion, the London Forex session is a critical time for traders, particularly those operating on Eastern Standard Time. By understanding the timing and key features of this session, traders can leverage its advantages to enhance their trading performance. Employing effective strategies and risk management techniques will further enable traders to maximize their profits during these lucrative hours.

I learned that the London Forex session is from 3 AM to 12 PM EST. It’s good to know the timing!

High liquidity in the London session means better trades. I want to try trading then!

“Scalping” seems like a fun strategy during the London session. I want to learn more!

‘Prepare for volatility’ is a great tip! I will definitely keep that in mind.

It’s smart to focus on major currency pairs during this time for better results.

Understanding economic data releases can really help in Forex trading. Good point!

The overlap with other sessions is interesting! It must create more trading chances.

This article helps me understand when and how to trade better during the London session.

I didn’t know about Daylight Saving Time affecting trading hours. Thanks for the info!

“Continuous learning” is key in Forex. I’m excited to improve my strategies.