What is a Pip in Forex

Understanding the Concept of a Pip in Forex

In the world of Forex trading, the term “pip” is fundamental to understanding currency value changes. A “pip,” short for “percentage in point,” is the smallest price movement that a given exchange rate can make based on market convention. As one of the basic units of measurement in Forex, pips play a crucial role in both trading strategies and risk management.

The Role of Pips in Currency Value Fluctuations

Pips represent the smallest incremental change that can occur in the exchange rate of a currency pair. Here are some key points regarding their significance:

- Standard Measurement: Pips provide a standardized unit for measuring price changes in currency pairs, allowing traders to gauge entry and exit points with precision.

- Market Fluctuations: Currency prices fluctuate based on economic indicators, geopolitical events, and market sentiment. Pips quantify these fluctuations.

- Directional Movement: A price movement of one pip upward signifies an increase in the value of the base currency relative to the quote currency, while a movement downwards indicates a decrease.

Comparative Table of Pips in Different Currency Pairs

| Currency Pair | Pip Value (Standard Lot) | Pip Value (Mini Lot) | Pip Value (Micro Lot) |

|---|---|---|---|

| EUR/USD | $10 | $1 | $0.10 |

| USD/JPY | ¥1 | ¥0.1 | ¥0.01 |

| GBP/USD | $10 | $1 | $0.10 |

| AUD/CAD | $10 | $1 | $0.10 |

In this table, the pip value for a standard lot (100,000 units) in major currency pairs like EUR/USD and GBP/USD is $10, while mini (10,000 units) and micro (1,000 units) lots have values of $1 and $0.10, respectively.

How Pips Are Calculated in Forex Transactions

Calculating pips is relatively straightforward but varies slightly based on the currency pair being traded.

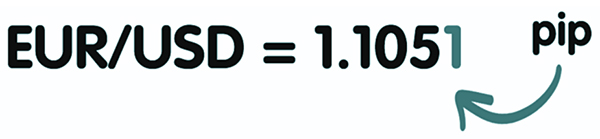

- Identify the Currency Pair: For instance, in the EUR/USD pair, the euro is the base currency and the US dollar is the quote currency.

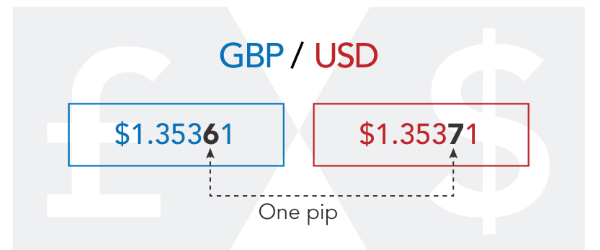

- Determine the Price Movement: If the EUR/USD moves from 1.1050 to 1.1051, it has moved one pip.

- Consider Decimal Points:

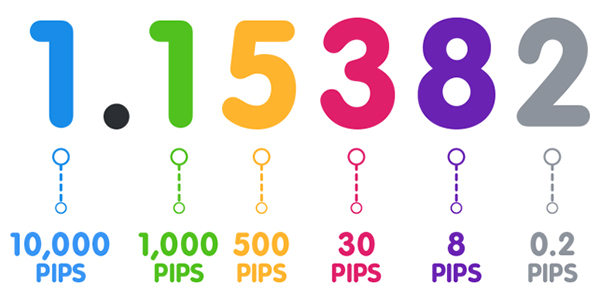

- For most pairs, one pip is the fourth decimal place (0.0001).

- For pairs involving the Japanese yen, it is the second decimal place (0.01).

Example Calculation:

If the USD/JPY moves from 110.50 to 110.57, that is a movement of 7 pips.

The Importance of Pips for Traders and Investors

Pips are more than just a unit of measurement; they are essential for effective risk management and trading strategy development. Here’s why they matter:

- Profit and Loss Calculation: Traders use pips to calculate their profit and loss for each trade. For example, if a trader buys EUR/USD at 1.1000 and sells it at 1.1050, they have gained 50 pips.

- Risk Assessment: Understanding pips allows traders to set stop-loss and take-profit orders accurately, helping them manage risks.

- Position Sizing: Knowing the pip value helps traders determine how much to risk on a trade based on their account size and risk tolerance.

Common Misconceptions About Pips in Forex Markets

There are several myths surrounding pips that can mislead new traders:

- Pips Are Only Important for Forex: While pips are primarily a Forex concept, they are also relevant in other financial markets, such as CFDs.

- Pips Are Fixed: The value of a pip can vary based on the lot size and the currency pair being traded. It is not a fixed amount.

- Only Experienced Traders Use Pips: Pips are a basic concept that all traders, regardless of experience, should understand.

Practical Tips for Trading with Pips Successfully

1. Start with a Demo Account: Before trading with real money, practice your understanding of pips in a demo account to build your confidence.

2. Use a Pip Calculator: Utilize online pip calculators to quickly assess the value of pips in your trades, especially when dealing with multiple currency pairs.

3. Maintain a Trading Journal: Document your trades, including pip movements, to analyze your performance and refine your strategies.

4. Keep Up to Date with Market Trends: Economic news can affect pip movements; stay informed to make better trading decisions.

5. Set Realistic Goals: Understand how many pips you aim to gain per trade and over a certain period—this clarity can guide your trading strategy.

Ultimately, understanding pips is essential for anyone looking to navigate the Forex markets successfully. Master this concept, and you’ll have a vital tool at your disposal for making informed trading decisions.

‘Profit and loss calculation’ using pips sounds interesting. I need to practice this.

‘Pips are not fixed’—this is good to know! I thought they were always the same.

Understanding pips seems crucial for managing trades. I will definitely keep this in mind.

This article really explains what a pip is in Forex. I had no idea it was so important!

The table showing pip values for different lots was very helpful. Thanks for sharing!

I learned that pips help with measuring currency changes. This is useful for beginners.

I appreciate the tips about using a demo account and pip calculators. Great advice!

‘Directional movement’ made me understand how currency values change. Very clear explanation!

“Keep up to date with market trends” sounds like solid advice for anyone in Forex trading.

“Start with a demo account” is a smart suggestion. I’ll try it before trading real money.