How to Calculate Pips in Forex

Calculating pips is a fundamental skill for anyone engaged in Forex trading. Pips, or “percentage in points,” are the smallest price movement that a given exchange rate can make based on market convention. Understanding how to calculate pips is crucial for effective risk management and trading strategy formulation.

Understanding the Concept of Pips in Forex Trading

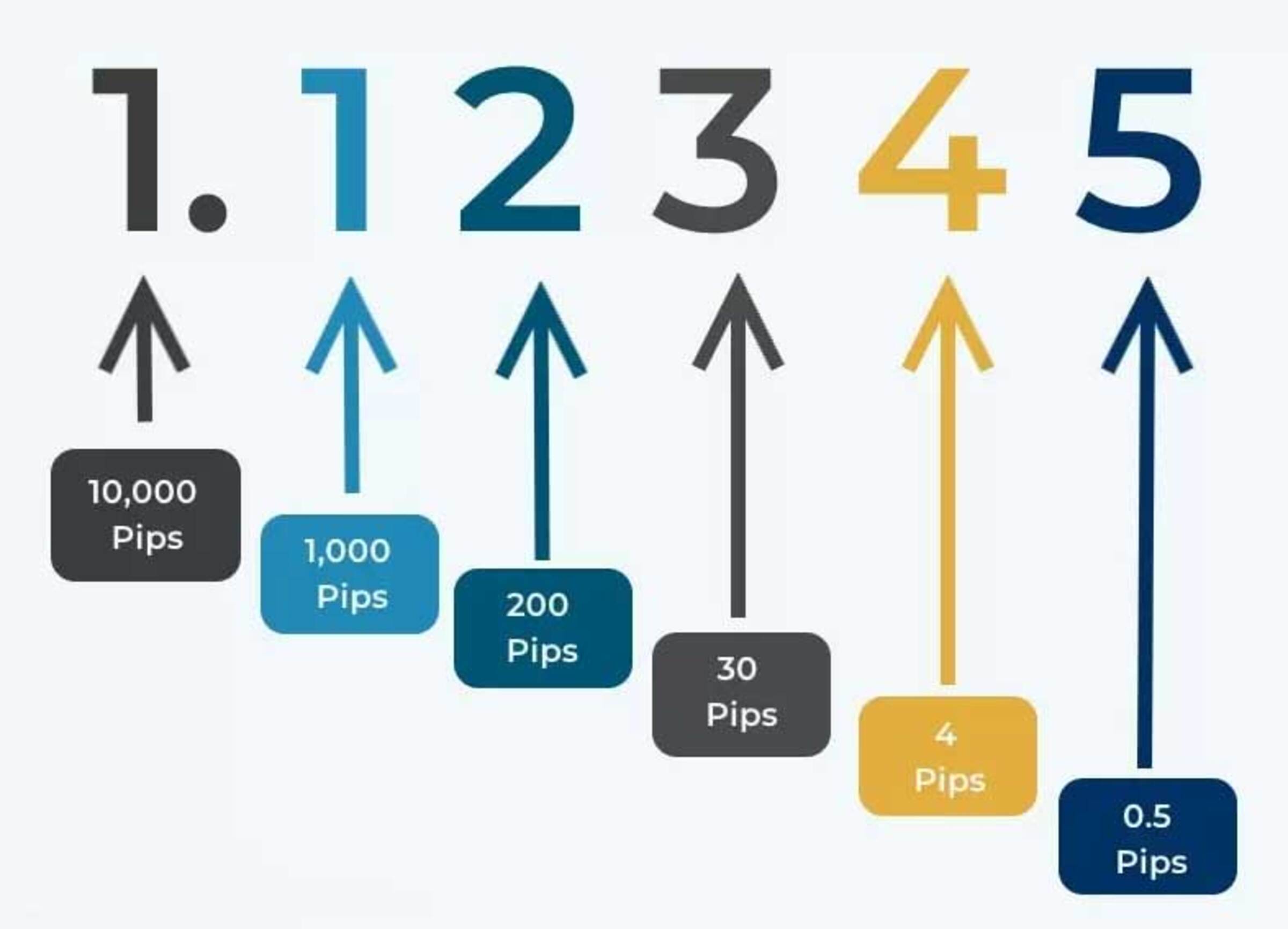

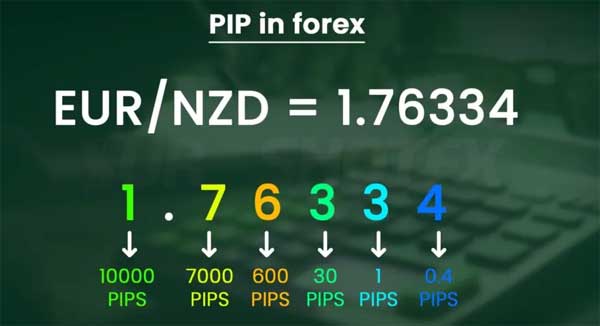

In Forex trading, a pip is typically the fourth decimal place of a currency pair’s price. For instance, if the EUR/USD moves from 1.1000 to 1.1005, it has moved five pips. However, for pairs involving the Japanese yen, a pip is the second decimal place, meaning a movement from 110.00 to 110.01 would represent a one pip movement.

Key Points:

- Standard Pip Value: For most currency pairs, a pip is 0.0001.

- Pip Value for Yen Pairs: For JPY pairs, a pip is 0.01.

- Pipettes: Some brokers quote prices to an additional decimal place, known as pipettes, which are one-tenth of a pip.

The Importance of Accurate Pip Calculation for Traders

Accurate pip calculation is essential for:

- Risk Management: Helps traders determine stop-loss and take-profit levels.

- Profit/Loss Estimation: Essential for calculating potential earnings or losses.

- Position Sizing: Determines the size of a trade, helping manage exposure and leverage efficiently.

Step-by-Step Guide to Calculating Pips in Forex

Calculating pips can be straightforward if you follow these steps:

Step 1: Identify the Currency Pair

Determine the currency pair you are trading (e.g., EUR/USD, GBP/USD).

Step 2: Note the Current Price

Check the current price of the currency pair. For example, if EUR/USD is at 1.1050.

Step 3: Identify the Movement

Determine the price change. If the price moves to 1.1070, the movement is 20 pips.

Step 4: Use the Formula

To calculate the number of pips:

- For most pairs:

[

text{Pips} = text{Price Change} div 0.0001

] - For JPY pairs:

[

text{Pips} = text{Price Change} div 0.01

]

Example Calculation:

- Currency Pair: EUR/USD

- Initial Price: 1.1050

- Final Price: 1.1070

- Price Change: 1.1070 – 1.1050 = 0.0020

- Pips: ( frac{0.0020}{0.0001} = 20 text{ pips} )

Different Currency Pairs and Their Pip Values Explained

Understanding the pip values of different currency pairs is important for accurate calculations. The following comparative table illustrates the pip values for common pairs:

| Currency Pair | Pip Value (Standard) | Pip Value (Yen) |

|---|---|---|

| EUR/USD | 0.0001 | N/A |

| GBP/USD | 0.0001 | N/A |

| USD/JPY | N/A | 0.01 |

| AUD/USD | 0.0001 | N/A |

| NZD/JPY | N/A | 0.01 |

Common Mistakes to Avoid When Calculating Pips

- Ignoring the Decimal Place: Always be aware of which decimal place represents a pip based on the currency pair.

- Confusing Pip with Pipette: A pipette is one-tenth of a pip; ensure clarity in calculations.

- Not Accounting for Spread: The spread can affect your actual pip gain or loss, so factor it into your calculations.

Tools and Resources for Simplifying Pip Calculations

With advancements in technology, traders can leverage various tools to simplify pip calculations. Here are some recommendations:

- Pip Calculators: Online calculators that automatically compute pip values based on current prices and position sizes.

- Trading Platforms: Most trading platforms come equipped with built-in calculators and features to track pips.

- Mobile Apps: Several apps provide functionalities to track pip movements, which can be helpful for traders on the go.

Practical Tips:

- Regularly update your knowledge about market changes and pip values.

- Utilize demo accounts to practice pip calculations without financial risk.

In conclusion, calculating pips accurately in Forex trading is essential for success. By mastering this fundamental skill, traders can enhance their trading strategies and minimize risks associated with currency fluctuations. Whether you choose to use manual calculations or leverage modern tools, ensuring accuracy will undoubtedly aid in achieving your trading goals.

‘Trading platforms with built-in calculators’ sounds convenient! I’ll check those out.

The example of EUR/USD was easy to follow. I appreciate the step-by-step guide.

This article clearly explains what pips are in Forex. Understanding this is very important.

I never knew how crucial pip calculations were for risk management. This is helpful!

I learned that pipettes are different from pips. That’s good to know!

‘Not Accounting for Spread’ can really affect profits, thanks for highlighting that!

‘Ignoring the Decimal Place’ mistake is something I’ve done before. Good reminder!

Thanks for explaining how to calculate pips! I feel more confident about trading now.

‘Regularly updating knowledge’ is a great tip! The market changes so fast.

‘Position Sizing’ is an interesting point. It helps me understand my trade exposure better.