What is a Forex Pip?

In the world of foreign exchange (Forex) trading, understanding terminology is crucial for both novice and experienced traders alike. One of the most essential terms in this market is “pip.” This article aims to provide a comprehensive understanding of what a pip is, its significance in currency trading, and how it influences strategies and profit calculations.

Understanding the Basics of Forex Trading Terminology

Forex trading refers to the process of buying and selling currency pairs on the global market. In this context, a pip is a unit of measurement for the price movement of a currency pair. It represents the smallest price change that can occur in a currency pair based on market convention.

Key Terminology

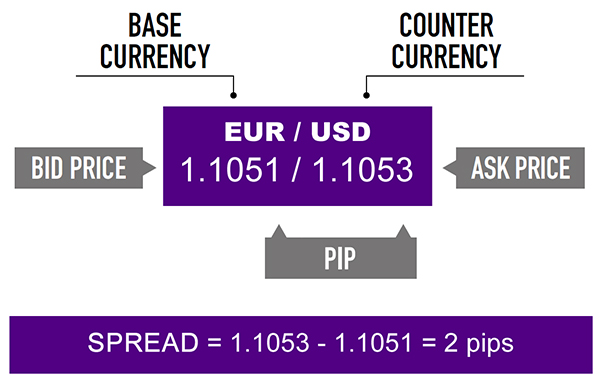

- Currency Pair: A pairing of two different currencies, such as EUR/USD (Euro/US Dollar).

- Base Currency: The first currency in a pair, which is being bought or sold.

- Quote Currency: The second currency in a pair, used to determine the value of the base currency.

- Spread: The difference between the bid price and the ask price of a currency pair.

Definition of a Pip in the Forex Market Explained

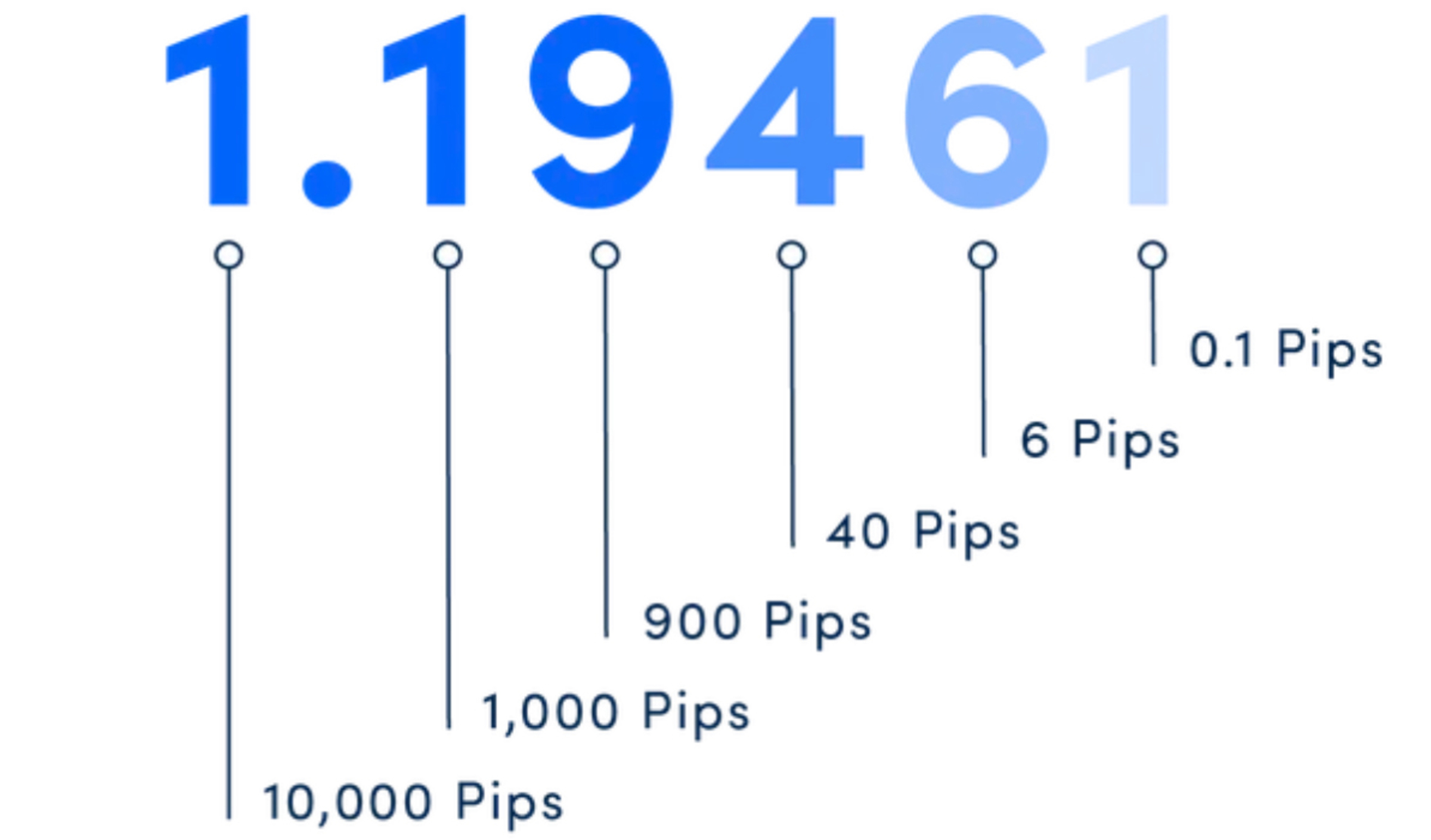

A pip is typically the fourth decimal place in a currency price, or the second decimal in pairs involving the Japanese Yen. For example:

- In the currency pair EUR/USD, if the price moves from 1.1050 to 1.1051, it has moved 1 pip.

- In the currency pair USD/JPY, if the price moves from 110.00 to 110.01, it has moved 1 pip.

Comparative Table

| Currency Pair | Pip Definition | Example Movement |

|---|---|---|

| EUR/USD | 0.0001 | 1.1050 to 1.1051 |

| USD/JPY | 0.01 | 110.00 to 110.01 |

| GBP/USD | 0.0001 | 1.2900 to 1.2901 |

| AUD/CAD | 0.0001 | 0.9400 to 0.9401 |

How Pips Influence Currency Trading Strategies

Pips play a critical role in various trading strategies. Traders often use pip movements to determine entry and exit points, along with setting stop-loss and take-profit levels. Here are some ways pips influence trading strategies:

- Risk Management: Traders may determine how many pips they are willing to risk on a trade to protect their capital.

- Position Sizing: The value of a pip can help traders determine the size of their positions based on their risk tolerance.

- Technical Analysis: Many indicators and patterns rely on pip movements to signal potential price trends.

The Role of Pips in Calculating Forex Profits and Losses

Calculating profits and losses in Forex trading involves understanding how many pips you gain or lose on a trade. Here’s how pips translate into actual monetary value:

Example Calculation

- Account Size: $10,000

- Trade Size: 1 Lot (100,000 units)

- Currency Pair: EUR/USD

- Pip Value for 1 Lot: Approximately $10

If you buy the EUR/USD at 1.1050 and sell it at 1.1070, you’ve made a profit of 20 pips. Thus, your profit calculation would be:

Profit = 20 pips × $10 per pip = $200

Conversely, if the trade went against you and you sold at 1.1030, you would incur a loss of 20 pips, leading to:

Loss = 20 pips × $10 per pip = -$200

Common Misconceptions About Pips in Forex Trading

Despite their importance, several misconceptions about pips exist in the Forex community:

- All Pips Are Equal: This is false; the monetary value of a pip can vary depending on the currency pair and the trade size.

- Pips Only Matter in Major Pairs: While major pairs often have more liquidity, pips are relevant in all currency pairs.

- High Pip Value Equals High Profit: A higher pip movement does not necessarily mean a higher profit, as it also depends on the trade size.

Practical Examples: Pips in Real-World Forex Scenarios

Example 1: Trading the GBP/USD

Imagine you buy GBP/USD at 1.2900. Later, the price rises to 1.2950. The movement of 50 pips results in a profit of $500 if you traded 1 lot (the pip value is approximately $10).

Example 2: Trading USD/JPY

If you sell USD/JPY at 110.00 and the price drops to 109.50, you have achieved a profit of 50 pips. If you were trading 2 lots, your total profit would amount to $1,000 ($10 per pip × 50 pips × 2 lots).

Conclusion

Understanding pips is fundamental for anyone looking to trade Forex successfully. By grasping how pips function, traders can create effective strategies, manage risks, and calculate potential profits or losses accurately. Keep these insights in mind as you navigate the complex world of Forex trading, ensuring that you are well-equipped to make informed decisions.

I didn’t know pips could influence trading strategies so much. Thanks for the info!

This article explains what a pip is very well. It’s helpful for beginners!

‘Spread’ definition is helpful too, as I often get confused by it.

‘GBP/USD at 1.2900’ example made it easy to follow along. Thanks!

I learned about the role of pips in risk management here. Very useful!

Great examples in the article! It really helps to see how profits are calculated.

The definition of a pip was clear. I understand it better now.

‘Pip value can vary’ is something I needed clarification on, and this article did that.

‘All pips are equal’ misconception is interesting. Good to know!

‘Technical analysis’ part was insightful. I’ll use this in my trading.