When Will Forex Market Open

In the ever-evolving world of finance, forex trading stands out as a highly dynamic and lucrative market. However, understanding when the forex market opens is crucial for traders looking to capitalize on opportunities. This article delves into the intricacies of forex market hours, including the specific opening and closing times across major trading sessions, the effects of time zones, and practical strategies for effective trading during these hours.

Understanding Forex Market Hours: A Comprehensive Guide

The forex market operates 24 hours a day, five days a week, allowing traders from all around the world to engage in currency trading. Unlike stock markets, which have fixed hours, the forex market is decentralized and operates continuously due to overlapping trading sessions across different global financial centers.

Key Aspects of Forex Market Hours:

- 24/5 Operation: The market is open from Sunday evening to Friday evening (GMT).

- Decentralized Nature: Trading occurs globally without a centralized exchange.

- Continuous Trading: Traders can enter or exit positions at any time during market hours.

The Global Nature of Forex Trading and Its Market Hours

The forex market is truly global. It operates in different time zones, with major financial hubs playing a crucial role. The four primary forex trading sessions are:

- Asian Session (Tokyo)

- European Session (London)

- North American Session (New York)

- Australian Session (Sydney)

Each session has unique characteristics and trading volumes, contributing to price volatility and market opportunities.

Comparative Table of Trading Sessions:

| Trading Session | Opening Time (GMT) | Closing Time (GMT) |

|---|---|---|

| Asian Session | 00:00 | 09:00 |

| European Session | 07:00 | 16:00 |

| North American Session | 12:00 | 21:00 |

Opening and Closing Times for Major Forex Trading Sessions

Understanding the opening and closing times for these sessions is vital for traders. Below is a breakdown of the major trading sessions:

- Asian Session: Opens at 00:00 GMT and closes at 09:00 GMT. This session is known for lower volatility and is dominated by the Japanese yen, Australian dollar, and New Zealand dollar.

- European Session: Opens at 07:00 GMT and closes at 16:00 GMT. This session is the most active, as it overlaps with both the Asian and North American sessions, leading to higher volatility and trading volume. The euro and British pound are predominantly traded during this time.

- North American Session: Opens at 12:00 GMT and closes at 21:00 GMT. This session experiences significant trading activity, particularly with the US dollar.

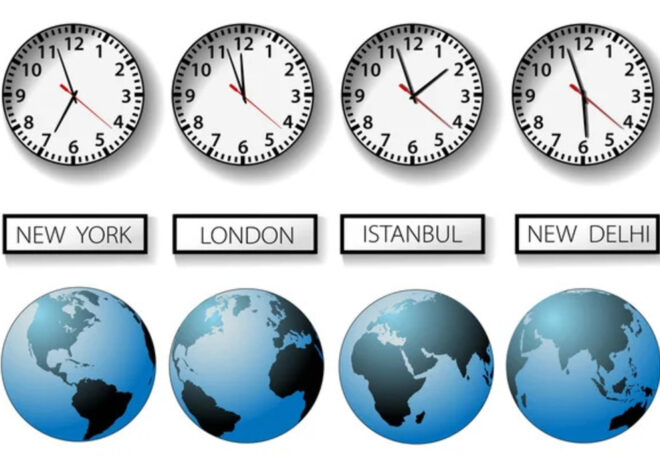

Time Zone Impacts on Forex Market Accessibility Worldwide

The global nature of forex trading means that time zones significantly impact when traders can access the market. For traders in different regions, understanding how time zones affect their trading hours is essential. Here’s a brief rundown of how time zones convert forex market hours:

- GMT+0 (London): Standard for forex trading hours.

- GMT+1 (Central European Time): Adjust trading hours to 08:00 – 17:00 for the European session.

- GMT-5 (Eastern Standard Time): Trading hours for the North American session shift to 07:00 – 16:00.

- GMT+8 (Singapore): Adjusted trading hours for the Asian session from 08:00 – 17:00.

Practical Tips:

- Utilize world clock applications to track time zones effectively.

- Familiarize yourself with Daylight Saving Time (DST) changes across regions.

Key Factors Influencing Forex Market Opening Times

Several factors influence forex market opening and participation:

- Economic Releases: Major economic indicators are often released at specific times, which can lead to increased volatility.

- Political Events: Elections, geopolitical tension, and other political events can affect currency stability and trading volume.

- Market Sentiment: Traders’ perceptions and speculative activities can impact market dynamics and liquidity.

Strategies for Trading Effectively During Market Open Hours

To make the most out of the forex market opening hours, consider the following strategies:

- Focus on Major Currency Pairs: During the European and North American sessions, major currency pairs such as EUR/USD, GBP/USD, and USD/JPY typically experience higher volumes and volatility.

- Utilize Technical Analysis: Employ chart patterns and indicators to identify potential entry and exit points during market open times.

- Stay Informed: Keep updated with economic calendars to anticipate major news releases and adjust trading strategies accordingly.

- Practice Risk Management: Use stop-loss orders and position sizing to manage risk, especially during volatile opening hours.

In conclusion, understanding when the forex market opens and the nuances of various trading sessions is crucial for traders aiming to leverage opportunities effectively. By familiarizing yourself with the global nature of forex trading, the impacts of time zones, and strategies tailored for market openings, you can enhance your trading potential and make informed decisions. As a trader, staying proactive and alert during these vital hours will undoubtedly contribute to more successful trading outcomes.

I learned that the forex market is open 24 hours! That’s so different from stocks.

‘Stay informed’ is a good strategy! I need to check economic calendars more.

‘Continuous Trading’ means we can trade whenever! That’s exciting!

Understanding the time zones is very important. I will use a world clock now!

The tips for effective trading during opening hours are useful. I will try them.

Great information about the different trading sessions. I’ll pay attention to them!

‘Practice Risk Management’ is important advice for me as a beginner.

‘Focus on Major Currency Pairs’ makes sense. I will focus on those pairs.

This article really explains the forex market hours well. It’s good to know when to trade.

I didn’t know economic releases could affect trading times. Very helpful!