What is Forex and How Does it Work

The Foreign Exchange Market, commonly known as Forex, is the world’s largest and most liquid financial market. With a daily trading volume exceeding $6 trillion, Forex offers unparalleled opportunities for traders and investors worldwide. This article aims to demystify Forex, detailing its mechanics, key players, and essential tips for those looking to enter this dynamic market.

Understanding Forex: The Global Currency Market Demystified

Forex trading involves the buying and selling of currencies. Unlike traditional stock markets, Forex operates 24 hours a day, five days a week, across various global financial centers. The primary purpose of Forex is to facilitate international trade and investment by allowing currency conversion.

Key Characteristics of Forex:

- Market Size: The Forex market is the largest financial market globally, dwarfing other markets like stocks and bonds.

- Liquidity: Due to high trading volumes, Forex offers high liquidity, meaning trades can be executed quickly and with minimal price fluctuation.

- Leverage: Forex brokers often provide leverage, allowing traders to control larger positions with a smaller amount of capital.

Key Players in the Forex Market: Who’s Involved?

The Forex market comprises several key players, each playing a pivotal role in the market’s functioning. Understanding these players helps in grasping how currency movements occur.

| Type of Player | Description | Example |

|---|---|---|

| Central Banks | National banks that manage currency reserves and monetary policy. | Federal Reserve (USA), ECB (Eurozone) |

| Commercial Banks | Financial institutions that facilitate currency transactions for clients. | JPMorgan Chase, HSBC |

| Corporations | Companies engaging in international trade requiring currency conversion. | Multinational corporations like Apple |

| Retail Traders | Individuals trading Forex for personal profit. | Day traders and investors |

| Institutional Traders | Large financial institutions managing substantial capital. | Pension funds, hedge funds |

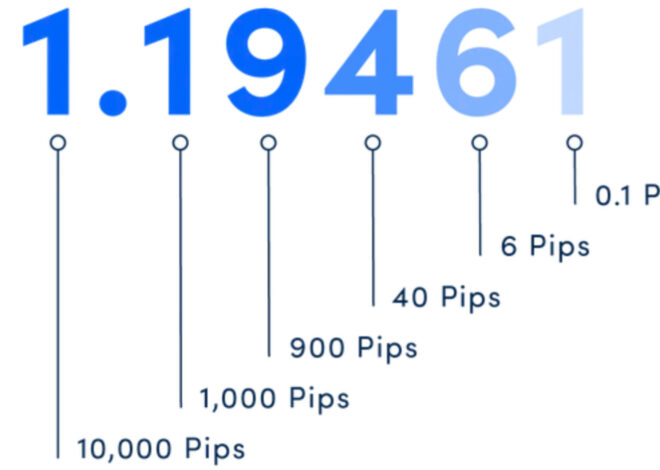

How Currency Pairs Function: The Basics of Trading

Forex trading involves currency pairs, where one currency is exchanged for another. Each currency pair consists of two components: the base currency and the quote currency.

Key Points to Remember:

- Base Currency: The first currency in a pair, representing how much of the quote currency is needed to purchase one unit of the base currency.

- Quote Currency: The second currency in the pair, which helps traders determine the exchange rate.

Example of Currency Pairs:

- EUR/USD: If the EUR/USD pair is trading at 1.20, it means 1 Euro is equivalent to 1.20 US Dollars.

- GBP/JPY: If GBP/JPY is at 150, it indicates that 1 British Pound can be exchanged for 150 Japanese Yen.

The Mechanics of Forex Trading: How Transactions Occur

Forex transactions occur through a network of banks, brokers, and electronic trading platforms. Here is a simplified view of the trading process:

- Choose a Forex Broker: Select a regulated broker that offers competitive spreads, trading tools, and educational resources.

- Create an Account: Open a trading account by providing necessary documentation and funding it with capital.

- Select a Currency Pair: Choose which currency pair to trade based on market analysis and trading strategy.

- Execute a Trade: Use the trading platform to place a buy or sell order for the chosen currency pair.

- Monitor and Close the Trade: Keep track of market movements and close the trade to realize profits or cut losses.

Risks and Rewards: Navigating the Forex Landscape

While Forex trading can be lucrative, it also comes with significant risks. Understanding these risks is crucial for effective trading.

Common Risks:

- Market Risk: The risk of losing money due to unfavorable market movements.

- Leverage Risk: High leverage can amplify profits but also result in substantial losses.

- Interest Rate Risk: Changes in interest rates can affect currency values.

- Political Risk: Geopolitical events can lead to volatility in currency prices.

Potential Rewards:

- High Liquidity: Enables traders to enter and exit positions without significant price changes.

- Profit Potential: Opportunities exist for profit in both rising and falling markets.

- Accessibility: Forex trading can be done from anywhere in the world with an internet connection.

Getting Started with Forex: Essential Tips for Beginners

For those looking to enter the Forex market, here are some essential tips:

- Educate Yourself: Understand the fundamentals of Forex trading, including technical and fundamental analysis.

- Practice with a Demo Account: Use demo accounts to practice trading without risking real money.

- Start with a Trading Plan: Develop a comprehensive trading plan that includes risk management strategies.

- Manage Your Risk: Never risk more than you can afford to lose, and use stop-loss orders to protect your capital.

- Stay Informed: Keep up with economic indicators, news, and global events that could affect currency values.

In conclusion, Forex presents a world of opportunities and challenges for traders and investors alike. By understanding the market’s mechanics, key players, and potential risks, you can navigate the Forex landscape more effectively. Whether you’re seeking to trade for a living or as a side venture, adherence to the fundamental principles of Forex trading is key to long-term success.

I learned that Forex is open all the time, unlike stock markets. That’s interesting!

It’s good to know about the risks involved in Forex trading. Thanks for the warning!

The tips for beginners are very helpful. I will definitely start with a demo account.

I didn’t understand what currency pairs were before reading this. Now it makes sense!

‘Monitoring trades’ seems important to avoid losses. Good advice!

‘Central banks’ play a big role in Forex. This info is really enlightening.

‘High liquidity’ means I can trade easily? That sounds great for beginners like me!

I didn’t know Forex was so big! $6 trillion is a lot of money. This article really explains it well.

‘Leverage’ sounds risky but also exciting! I want to learn more about it.