What is Lot Size in Forex

Forex trading, or foreign exchange trading, involves buying and selling currency pairs to generate profit. A fundamental concept in this realm is lot size, which plays a crucial role in determining trade volume, risk exposure, and potential profits. This article delves into what lot size means in Forex, its types, implications for risk management, and practical tips for traders.

Understanding Lot Size: A Fundamental Concept in Forex Trading

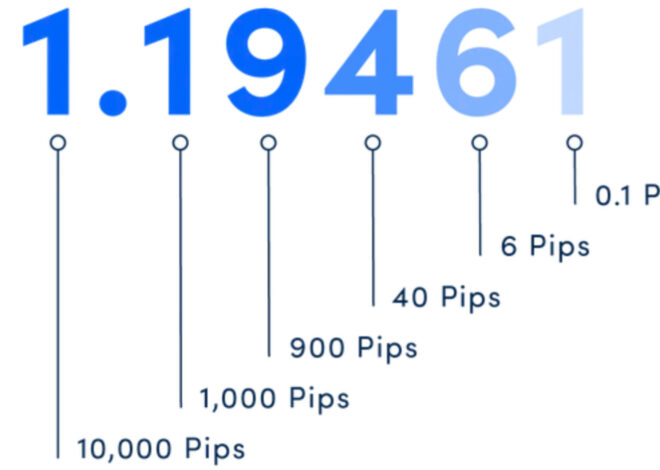

In Forex, a lot size refers to the amount of currency being traded. It acts as a standard measurement that determines the volume of a trade, impacting both potential gains and losses. Traders must understand lot size to effectively manage their trades and risk.

Key Points:

- Definition: Lot size is the volume of the currency pair being traded.

- Measurement: It is usually expressed in terms of standard lots, mini lots, and micro lots.

- Impact: The size of the lot directly influences the pip value, which is crucial for calculating profits and losses.

Types of Lot Sizes: Standard, Mini, and Micro Explained

In Forex, there are three main types of lot sizes that traders can choose from:

Lot Size Definitions:

| Lot Type | Size | Pip Value (USD) |

|---|---|---|

| Standard Lot | 100,000 units of currency | $10 per pip |

| Mini Lot | 10,000 units of currency | $1 per pip |

| Micro Lot | 1,000 units of currency | $0.10 per pip |

- Standard Lot: This is the most significant lot size in Forex trading, representing 100,000 units of the base currency. Trading in standard lots is suitable for traders with a more considerable capital base.

- Mini Lot: A mini lot represents 10,000 units of currency. This lot size is ideal for retail traders who want to trade with less risk compared to standard lots.

- Micro Lot: Micro lots are the smallest lot size at 1,000 units of currency. This option allows traders with limited capital to engage in the Forex market.

How Lot Size Affects Risk Management in Forex Trading

Lot size is integral to risk management strategies. Properly determining the appropriate lot size for each trade can help traders control their potential losses.

Key Considerations:

- Risk Tolerance: Traders should evaluate their risk tolerance and financial situation before determining their lot size.

- Account Size: The size of the trading account should influence the choice of lot size. A larger account may afford the risk of a standard lot, while a smaller account may necessitate micro or mini lots.

Example:

Imagine a trader with a $10,000 account and a willingness to risk 2% per trade. This means the maximum risk per trade is $200. If they choose to trade one standard lot (with a pip value of $10), they need to ensure that a 20-pip loss (20 pips x $10) does not exceed their risk tolerance. However, if they opt for a mini lot, a 20-pip loss would only result in a $20 loss, allowing more trades to fit within their risk parameters.

Calculating Position Size: The Role of Lot Size in Trades

Calculating the appropriate position size is essential for effective trade management. This involves determining the number of lots to trade based on account size, risk tolerance, and stop-loss placement.

Steps for Calculating Position Size:

- Determine Account Risk: Establish how much of your account you are willing to risk (e.g., 1-2%).

- Identify Stop Loss: Determine the distance between your entry point and stop-loss level in pips.

- Calculate Lot Size:

- Use the formula:

[

text{Position Size (in lots)} = frac{text{Account Risk} times text{Account Size}}{text{Stop Loss in Pips} times text{Pip Value}}

]

- Use the formula:

Lot Size and Leverage: Balancing Potential Gains and Risks

Leverage allows traders to control larger positions with a smaller amount of capital. However, it also amplifies risks. Understanding the interplay between lot size and leverage is vital.

Key Points:

- Higher Leverage: While high leverage can yield significant profits, it can also lead to substantial losses if the market moves against the trader.

- Lot Size Impact: A larger lot size increases exposure to market fluctuations, making risk management more critical.

Example:

If a trader uses 100:1 leverage and opens a position of one standard lot (100,000 units), they only need to maintain $1,000 in their account. However, if the market moves against them, they could face significant losses quickly.

Best Practices for Choosing the Right Lot Size in Forex

Choosing the appropriate lot size is pivotal for successful trading. Here are some best practices:

- Assess Risk Tolerance: Understand your comfort level with risks and losses.

- Utilize a Position Size Calculator: Many online tools can help determine the optimal lot size for your trades.

- Start Small: If you are new to Forex trading, consider starting with micro or mini lots to build your confidence and experience.

- Adjust as Needed: Regularly reassess your lot size based on changes in your trading strategy, account balance, and risk appetite.

Conclusion

Lot size in Forex trading is a critical element that influences risk management, position sizing, and overall trading strategy. By understanding the different types of lot sizes and how they affect trades, traders can make more informed decisions and better manage their risk exposure. Remember to continuously evaluate your approach to lot size, especially as your trading experience and account balance evolve, ensuring that you remain consistent with your risk management principles.

This article explains lot size well. I didn’t know there were micro lots!

‘Leverage can be risky!’ This article made me rethink my strategies.

‘Start small’ is good advice! I will definitely try micro lots first.

Wow, I learned a lot about pip values and how they relate to lot sizes.

‘Adjust as needed’ is a good reminder! Markets can change quickly.

‘Assessing risk tolerance’ makes sense. It’s better to trade safely.

Understanding risk management through lot size is crucial. Great tips!

‘Position size calculator’ sounds helpful. I need to find one online.

I appreciate the breakdown of different lot sizes. It’s useful for beginners.

Lot size is important! I will use mini lots to start my trading journey.